TCC #42: Redesigning the rules of corporate sustainability

Where business strategy meets the laws of nature (+ a micro-lesson on button copywriting)

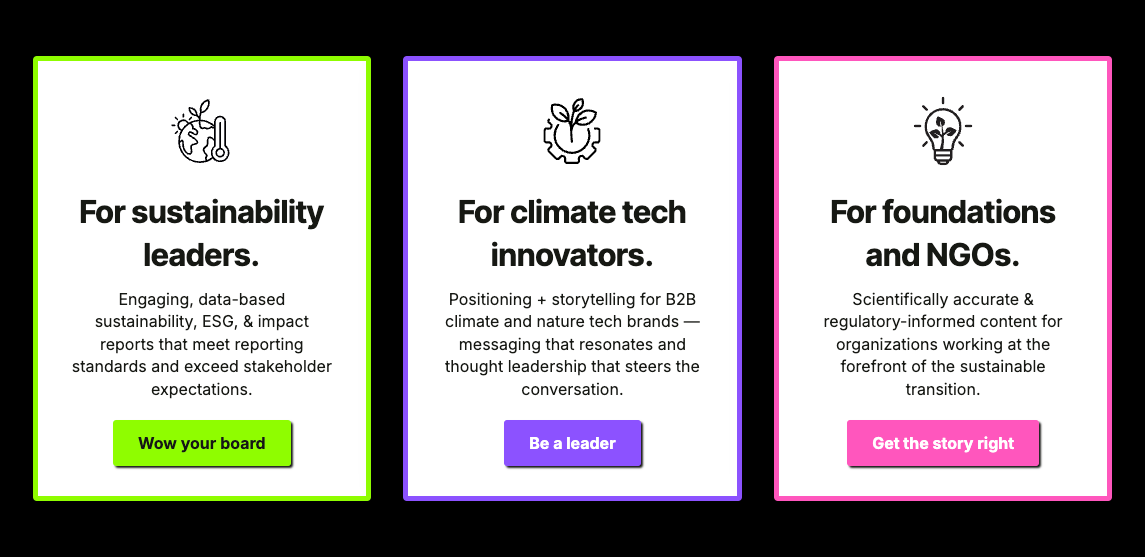

It’s been a month or so since Amelia and I launched V2 of The Climate Hub’s website. Gotta say, the first one did what we needed it to, but V2 is a huge upgrade. Previously we didn’t even have a portfolio page. Makes my little heart so happy to look at. Launching a site is work!

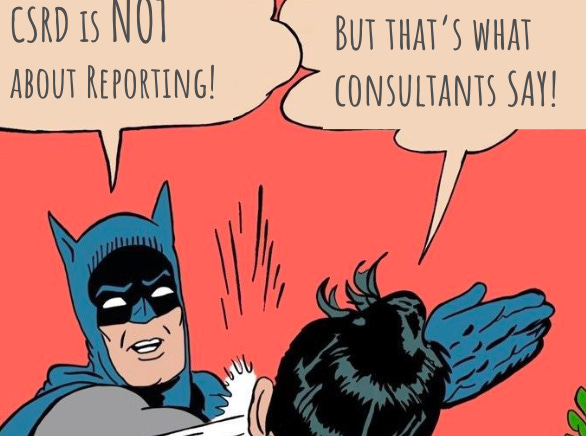

I’m telling you this because, last weekend, I read a discussion report from the Cambridge Institute for Sustainability Leadership that led me to question some of the button copy we wrote.

Let’s set the scene:

One company unveils a flashy new ESG initiative to thunderous boardroom applause. Across town, their competitor quietly invests in a supply chain overhaul designed to slash emissions by 50%. Ten years on, one company thrives, and one is out of business.

Guess which one?

When I wrote ‘Wow your board,’ I wasn’t wrong, per se. I believe corporates do want to wow their board, therefore making that green button a compelling one to click. The bigger issue is that focusing on ‘wowing the board’ is completely missing the point.

[A note on button copy: almost always opt for an outcome. ‘Learn more’ is boring.]

Encouraging corporates to ‘wow the board’ is continuing on the path we’ve been on. One that hasn’t been working. It’s a path defined by setting targets, ticking the compliance check box, and making incremental progress tied to risk management, reputation, and regulatory expectations — if any progress at all.

“Precious business resources should not be squandered on action that achieves only reputation kudos or which has negligible scale contribution to real-world change.”

Our fundamental problem is that markets today are not designed to deliver the climate action we need. Why? Because voluntary action is at odds with short-term commerciality. We reward short-term wins over long-term survival.

ESG actions, while a step forward, often paper over the cracks of a system that has yet to change. Until we realign incentives and put a price on environmental and social impact, the market will continue to work against the transition we desperately need.

What I found particularly interesting about the Cambridge paper is that the writers call for increased competition among businesses. This goes against what Amelia and I typically recommend, which is collaboration. (Because corporate sustainability only works if everyone does it.)

I really liked this framing though:

Instead of asking ‘How much sustainability-related activity can we afford?’ we must instead ask —

‘How do we win in this transition?’

The authors say competition is, after all, what drives capitalism and delivers change. And I have to agree with their premise: while the reality today is that we are failing — markets are still the best vehicle to deliver change at scale. However, we need to redesign them to favor sustainability.

I should acknowledge that it’s true that, yes, capitalism got us into this mess. It’s fair to question whether it can fix it. But the reality is that we don’t have the time to dismantle and rebuild an entirely new system before the most devastating effects of climate change begin to take hold. I have to believe that (some of) the change we need will happen within the framework we have. Let’s take bold action now — that we can manage with care — rather than waiting for it to all fall down around us. Then, we can look forward to what’s next.

An economic transition is inevitable. To quote the Cambridge paper: when things are unsustainable, they stop. Companies should work to reshape the markets on which they depend because we cannot do business on a dead planet.

The writers argue that the imperative for action should not be grounded in morality or market sentiment, but rather the hard and fast laws of nature.

“Climate change and biodiversity loss are not philosophical questions or moral dilemmas, they are physics, chemistry and biology imposing practical and non-negotiable limits on business as usual.”

Without market-wide shifts (strong government policy), short-term ESG wins will become irrelevant. There are two options ahead of us:

We can solve surface-level problems and land hard with system collapse.

Or we can shift the market, managing this transition and ensuring a landing that’s as soft as it can be. This is what ‘winning in the transition’ looks like — positioning to thrive in the new order.

Let’s stop aiming to wow the board and start aiming to shape the future.